RESUME AND JOB

RESUME AND JOB

Assistant Manager, Specialized Collection

Standard Chartered

Assistant Manager, Specialized Collection

Job Description

Job Summary

Strategy

• Support manager to develop and implement effective collection strategies and standardized operation procedures for IDRP (Industry Debt Restructuring Program) and coordinate with both internal and external stakeholders.

• Good command of credit and financial analysis capacity, to support IDRP case execution and inter-institutional coordination.

• Follow implemented end-to-end process on IDRP proposal when SCB acts lead bank.

• Actively support across function within Collections team as cross back-up or job rotation as requested by team manager.

• To back up internal team regarding the IDRP handling when SCB acts participant bank.

• Ensure good control mechanisms are in place and to ensure complied with Code of Banking Practice and the Bank’s standard.

• To identify and execute workflow re-engineering processes and simplify.

Business

• To ensure capacity planning in good order with objectives of less credit losses and more recovery.

• Assist manager to ensure good control mechanisms are in place and ensure satisfactory audit clearance and operational assurance.

• To ensure / improve operations effectiveness and KPIs.

• To identify and execute workflow re-engineering processes.

Key Responsibilities

Processes

• Organize comprehensive financial analysis and debt servicing capacity assessment of debtors.

• Support team to well proceed IDRP drawdown in accordance with approval and maintain database in accurate and timely manner.

• Follow IDRP workflow and formulate the restructuring proposals and facilitate consensus among creditors.

• Drive internal approval processes and regulatory reporting for restructuring plans.

• Manage the collection of repayment funds and distributing proceeds to creditors according to agreed proportions.

• Ensure IDRP service fee calculation and issue invoice/collect the fees.

• Continuously monitor debtor performance and regularly reporting progress to stakeholders.

• To ensure compliance with Group and Local policies, procedures, and codes, including anti-money laundering.

• To ensure compliance with Local Laws and Regulations that the Risk Function have Risk Control ownership, as defined in the Operational Risk Framework.

People & Talent

• Assist to strengthen team capacity and continue engagement with people.

• Enhance communication within and among team across Retail Risk Organizations as well as other internal stakeholders and external stakeholders.

Risk Management

• Display exemplary conduct and live by the Group’s Values and Code of Conduct.

• Take responsibility for embedding the highest standards of ethics, including regulatory and business conduct, across Standard Chartered Bank, this includes understanding and ensuring compliance with, in letter Assist to strengthen team capacity and continue engagement with people.

• Enhance communication within and among team across Retail Risk Organizations as well as other internal stakeholders and external stakeholders.

• all applicable laws, regulations, guidelines and the Group Code of Conduct.

• Effectively and collaboratively identify, escalate, mitigate and resolve risk, conduct and compliance matters.

• To ensure that the risks arising from litigation, environmental claims, regulatory censure, or potential reputational loss are minimized.

Governance

• Ensure all collection policies and procedures comply with Group Policies and Standards. Assure proper and updated documentation of all in- country policies and procedures are maintained at all times.

• To be well versed in relevant law & regulations to provide guidance in legal issues.

Regulatory & Business Conduct

• Display exemplary conduct and live by the Group’s Values and Code of Conduct.

• Take personal responsibility for embedding the highest standards of ethics, including regulatory and business conduct, across Standard Chartered Bank. This includes understanding and ensuring compliance with, in letter and spirit, all applicable laws, regulations, guidelines and the Group Code of Conduct.

• Effectively and collaboratively identify, escalate, mitigate and resolve risk, conduct and compliance matters.

Key stakeholders

Internal

• WRB Operations

• Product

• Risk

External

• IDRP participant Banks

• HKAB

Qualifications

• Education: University Degree

• Languages: English, Cantonese

Skills and Experience

• Manage Conduct

• Manage Operational and Reputation Risk

• Stakeholder Management

• Analytical and Critical Thinking

• Data Science

About Standard Chartered

We're an international bank, nimble enough to act, big enough for impact. For more than 170 years, we've worked to make a positive difference for our clients, communities, and each other. We question the status quo, love a challenge and enjoy finding new opportunities to grow and do better than before. If you're looking for a career with purpose and you want to work for a bank making a difference, we want to hear from you. You can count on us to celebrate your unique talents and we can't wait to see the talents you can bring us.

Our purpose, to drive commerce and prosperity through our unique diversity, together with our brand promise, to be here for good are achieved by how we each live our valued behaviours. When you work with us, you'll see how we value difference and advocate inclusion.

Together we:

- Do the right thing and are assertive, challenge one another, and live with integrity, while putting the client at the heart of what we do

- Never settle, continuously striving to improve and innovate, keeping things simple and learning from doing well, and not so well

- Are better together, we can be ourselves, be inclusive, see more good in others, and work collectively to build for the long term

What we offer

In line with our Fair Pay Charter, we offer a competitive salary and benefits to support your mental, physical, financial and social wellbeing.

- Core bank funding for retirement savings, medical and life insurance, with flexible and voluntary benefits available in some locations.

- Time-off including annual leave, parental/maternity (20 weeks), sabbatical (12 months maximum) and volunteering leave (3 days), along with minimum global standards for annual and public holiday, which is combined to 30 days minimum.

- Flexible working options based around home and office locations, with flexible working patterns.

- Proactive wellbeing support through Unmind, a market-leading digital wellbeing platform, development courses for resilience and other human skills, global Employee Assistance Programme, sick leave, mental health first-aiders and all sorts of self-help toolkits

- A continuous learning culture to support your growth, with opportunities to reskill and upskill and access to physical, virtual and digital learning.

- Being part of an inclusive and values driven organisation, one that embraces and celebrates our unique diversity, across our teams, business functions and geographies - everyone feels respected and can realise their full potential.

Locations

- ShenZhen, CHN

Salary

90,000 - 160,000 USD / yearly

Source: ai estimated

* This is an estimated range based on market data and may vary based on experience and qualifications.

Skills Required

- Credit and financial analysisintermediate

- Debt restructuring (IDRP)intermediate

- Collection strategiesintermediate

- Stakeholder coordinationintermediate

- Compliance managementintermediate

Responsibilities

- Organize comprehensive financial analysis and debt servicing capacity assessment

- Support IDRP drawdown and maintain database

- Follow IDRP workflow and formulate restructuring proposals

- Drive internal approval processes and regulatory reporting

- Manage collection of repayment funds and distribute proceeds

- Ensure compliance with Group and Local policies

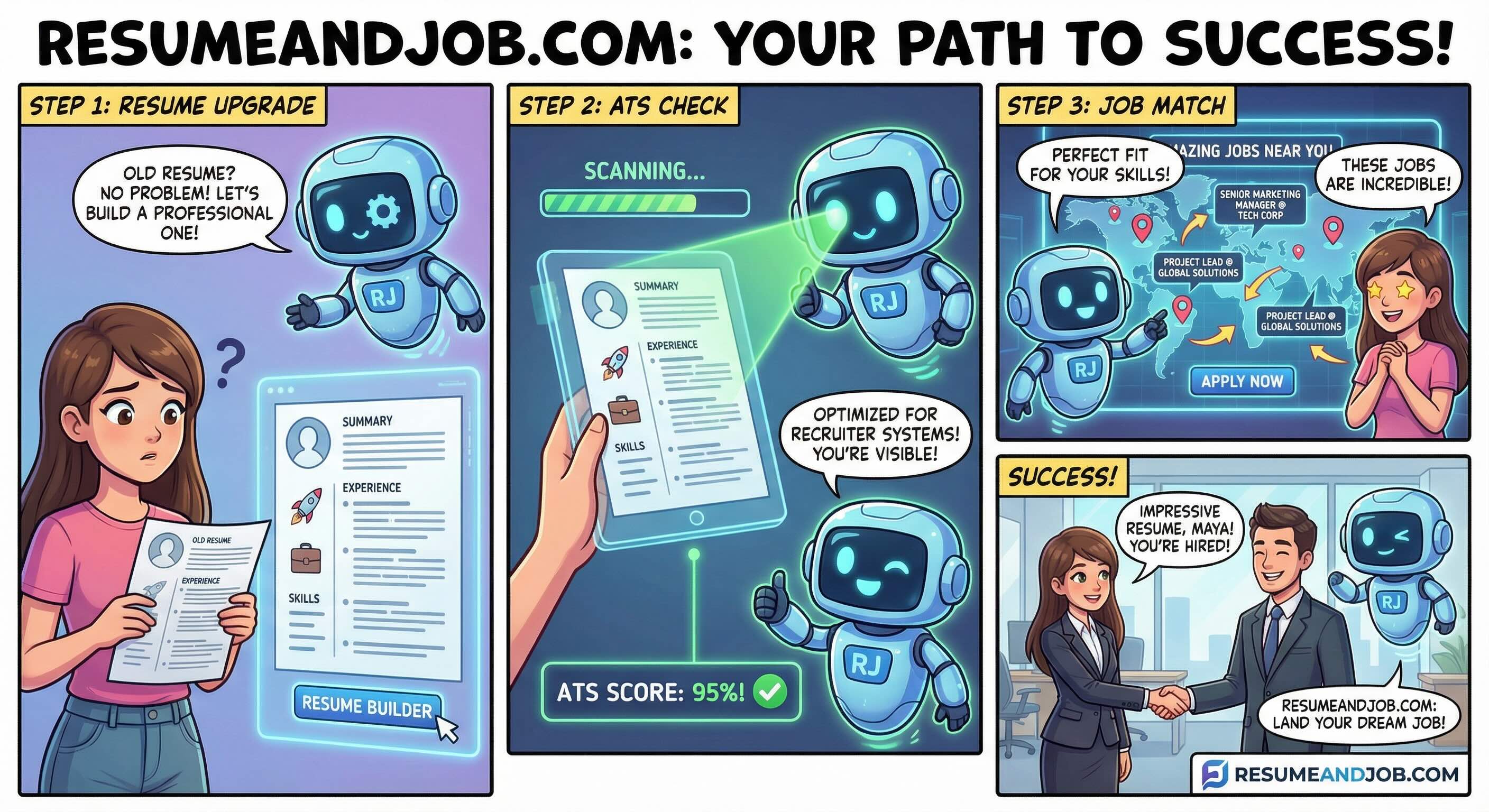

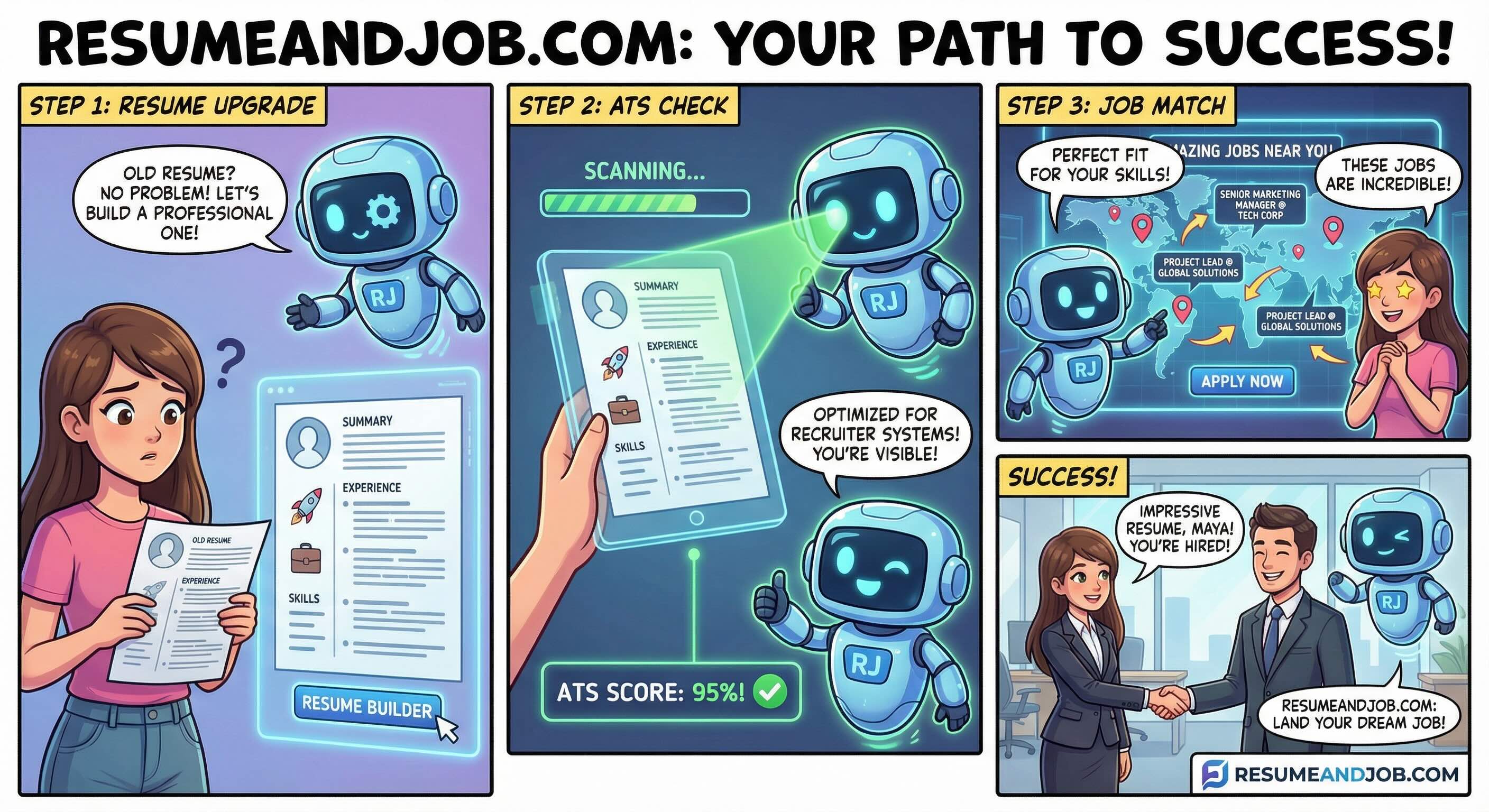

Target Your Resume for "Assistant Manager, Specialized Collection" , Standard Chartered

Get personalized recommendations to optimize your resume specifically for Assistant Manager, Specialized Collection. Takes only 15 seconds!

Check Your ATS Score for "Assistant Manager, Specialized Collection" , Standard Chartered

Find out how well your resume matches this job's requirements. Get comprehensive analysis including ATS compatibility, keyword matching, skill gaps, and personalized recommendations.

Answer 10 quick questions to check your fit for Assistant Manager, Specialized Collection @ Standard Chartered.

Related Books and Jobs

No related jobs found at the moment.

© 2026 Pro Partners. All rights reserved.

Assistant Manager, Specialized Collection

Standard Chartered

Assistant Manager, Specialized Collection

Job Description

Job Summary

Strategy

• Support manager to develop and implement effective collection strategies and standardized operation procedures for IDRP (Industry Debt Restructuring Program) and coordinate with both internal and external stakeholders.

• Good command of credit and financial analysis capacity, to support IDRP case execution and inter-institutional coordination.

• Follow implemented end-to-end process on IDRP proposal when SCB acts lead bank.

• Actively support across function within Collections team as cross back-up or job rotation as requested by team manager.

• To back up internal team regarding the IDRP handling when SCB acts participant bank.

• Ensure good control mechanisms are in place and to ensure complied with Code of Banking Practice and the Bank’s standard.

• To identify and execute workflow re-engineering processes and simplify.

Business

• To ensure capacity planning in good order with objectives of less credit losses and more recovery.

• Assist manager to ensure good control mechanisms are in place and ensure satisfactory audit clearance and operational assurance.

• To ensure / improve operations effectiveness and KPIs.

• To identify and execute workflow re-engineering processes.

Key Responsibilities

Processes

• Organize comprehensive financial analysis and debt servicing capacity assessment of debtors.

• Support team to well proceed IDRP drawdown in accordance with approval and maintain database in accurate and timely manner.

• Follow IDRP workflow and formulate the restructuring proposals and facilitate consensus among creditors.

• Drive internal approval processes and regulatory reporting for restructuring plans.

• Manage the collection of repayment funds and distributing proceeds to creditors according to agreed proportions.

• Ensure IDRP service fee calculation and issue invoice/collect the fees.

• Continuously monitor debtor performance and regularly reporting progress to stakeholders.

• To ensure compliance with Group and Local policies, procedures, and codes, including anti-money laundering.

• To ensure compliance with Local Laws and Regulations that the Risk Function have Risk Control ownership, as defined in the Operational Risk Framework.

People & Talent

• Assist to strengthen team capacity and continue engagement with people.

• Enhance communication within and among team across Retail Risk Organizations as well as other internal stakeholders and external stakeholders.

Risk Management

• Display exemplary conduct and live by the Group’s Values and Code of Conduct.

• Take responsibility for embedding the highest standards of ethics, including regulatory and business conduct, across Standard Chartered Bank, this includes understanding and ensuring compliance with, in letter Assist to strengthen team capacity and continue engagement with people.

• Enhance communication within and among team across Retail Risk Organizations as well as other internal stakeholders and external stakeholders.

• all applicable laws, regulations, guidelines and the Group Code of Conduct.

• Effectively and collaboratively identify, escalate, mitigate and resolve risk, conduct and compliance matters.

• To ensure that the risks arising from litigation, environmental claims, regulatory censure, or potential reputational loss are minimized.

Governance

• Ensure all collection policies and procedures comply with Group Policies and Standards. Assure proper and updated documentation of all in- country policies and procedures are maintained at all times.

• To be well versed in relevant law & regulations to provide guidance in legal issues.

Regulatory & Business Conduct

• Display exemplary conduct and live by the Group’s Values and Code of Conduct.

• Take personal responsibility for embedding the highest standards of ethics, including regulatory and business conduct, across Standard Chartered Bank. This includes understanding and ensuring compliance with, in letter and spirit, all applicable laws, regulations, guidelines and the Group Code of Conduct.

• Effectively and collaboratively identify, escalate, mitigate and resolve risk, conduct and compliance matters.

Key stakeholders

Internal

• WRB Operations

• Product

• Risk

External

• IDRP participant Banks

• HKAB

Qualifications

• Education: University Degree

• Languages: English, Cantonese

Skills and Experience

• Manage Conduct

• Manage Operational and Reputation Risk

• Stakeholder Management

• Analytical and Critical Thinking

• Data Science

About Standard Chartered

We're an international bank, nimble enough to act, big enough for impact. For more than 170 years, we've worked to make a positive difference for our clients, communities, and each other. We question the status quo, love a challenge and enjoy finding new opportunities to grow and do better than before. If you're looking for a career with purpose and you want to work for a bank making a difference, we want to hear from you. You can count on us to celebrate your unique talents and we can't wait to see the talents you can bring us.

Our purpose, to drive commerce and prosperity through our unique diversity, together with our brand promise, to be here for good are achieved by how we each live our valued behaviours. When you work with us, you'll see how we value difference and advocate inclusion.

Together we:

- Do the right thing and are assertive, challenge one another, and live with integrity, while putting the client at the heart of what we do

- Never settle, continuously striving to improve and innovate, keeping things simple and learning from doing well, and not so well

- Are better together, we can be ourselves, be inclusive, see more good in others, and work collectively to build for the long term

What we offer

In line with our Fair Pay Charter, we offer a competitive salary and benefits to support your mental, physical, financial and social wellbeing.

- Core bank funding for retirement savings, medical and life insurance, with flexible and voluntary benefits available in some locations.

- Time-off including annual leave, parental/maternity (20 weeks), sabbatical (12 months maximum) and volunteering leave (3 days), along with minimum global standards for annual and public holiday, which is combined to 30 days minimum.

- Flexible working options based around home and office locations, with flexible working patterns.

- Proactive wellbeing support through Unmind, a market-leading digital wellbeing platform, development courses for resilience and other human skills, global Employee Assistance Programme, sick leave, mental health first-aiders and all sorts of self-help toolkits

- A continuous learning culture to support your growth, with opportunities to reskill and upskill and access to physical, virtual and digital learning.

- Being part of an inclusive and values driven organisation, one that embraces and celebrates our unique diversity, across our teams, business functions and geographies - everyone feels respected and can realise their full potential.

Locations

- ShenZhen, CHN

Salary

90,000 - 160,000 USD / yearly

Source: ai estimated

* This is an estimated range based on market data and may vary based on experience and qualifications.

Skills Required

- Credit and financial analysisintermediate

- Debt restructuring (IDRP)intermediate

- Collection strategiesintermediate

- Stakeholder coordinationintermediate

- Compliance managementintermediate

Responsibilities

- Organize comprehensive financial analysis and debt servicing capacity assessment

- Support IDRP drawdown and maintain database

- Follow IDRP workflow and formulate restructuring proposals

- Drive internal approval processes and regulatory reporting

- Manage collection of repayment funds and distribute proceeds

- Ensure compliance with Group and Local policies

Target Your Resume for "Assistant Manager, Specialized Collection" , Standard Chartered

Get personalized recommendations to optimize your resume specifically for Assistant Manager, Specialized Collection. Takes only 15 seconds!

Check Your ATS Score for "Assistant Manager, Specialized Collection" , Standard Chartered

Find out how well your resume matches this job's requirements. Get comprehensive analysis including ATS compatibility, keyword matching, skill gaps, and personalized recommendations.

Answer 10 quick questions to check your fit for Assistant Manager, Specialized Collection @ Standard Chartered.

Related Books and Jobs

No related jobs found at the moment.

© 2026 Pro Partners. All rights reserved.